The company will launch new associate programs which leverage the passion and expertise of its workforce to create a positive impact on the next generation

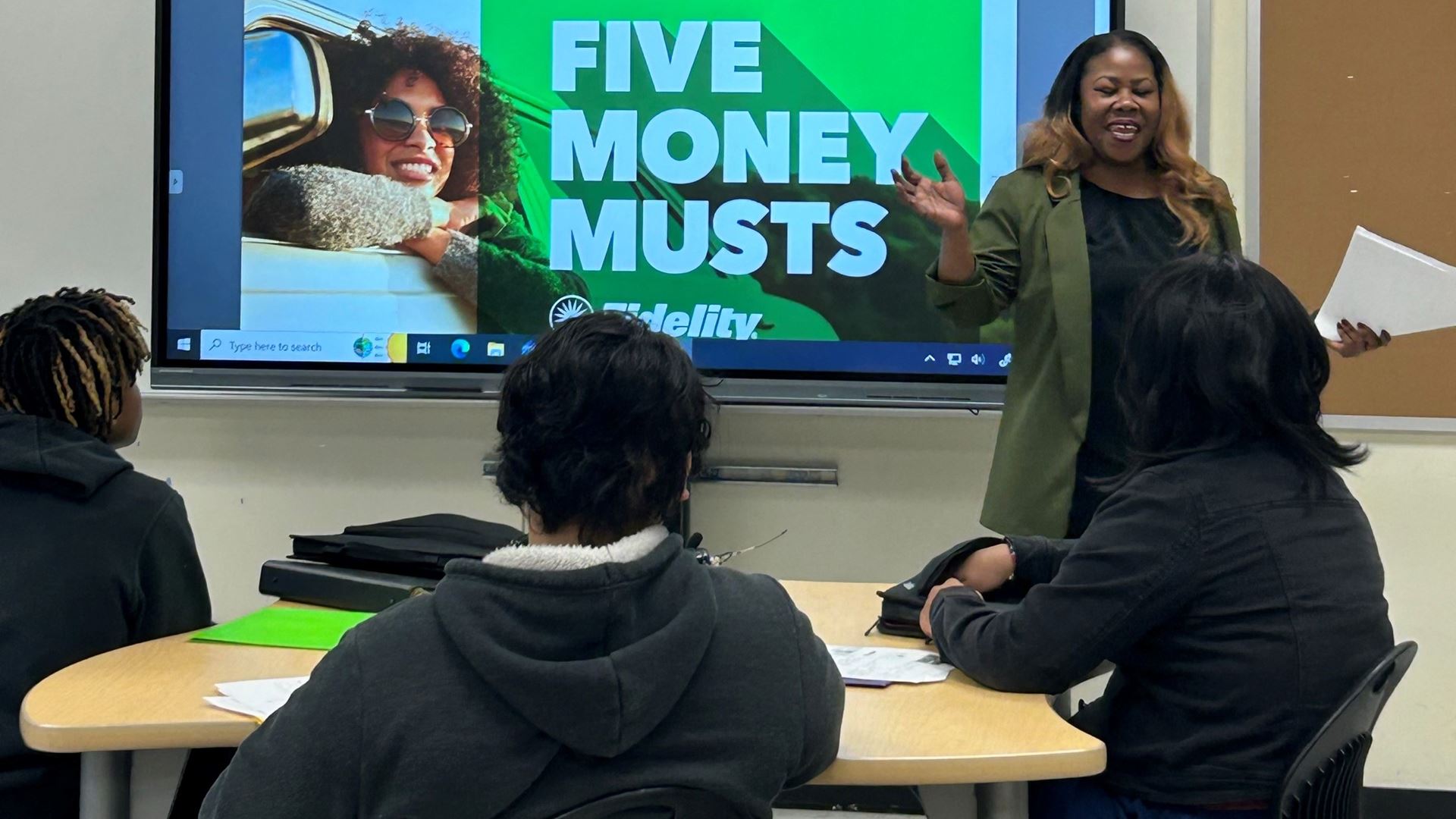

BOSTON, April 1, 2024 – Today, Fidelity Investments® is announcing its latest commitment to financial education and the next generation of investors. The company—which has reached more than 550,000 students with financial education over the past decade—is activating several new initiatives to tap the passion and continued engagement of its 74,000+ associates to help make a difference in its communities.

“The expertise of our associates is one of Fidelity’s greatest strengths. Financial education is simply what we do, whether that’s through our volunteer work in the community or in the products and services we offer our customers,” says Pamela Everhart, Head of Regional Public Affairs, Inclusion, and Impact at Fidelity Investments. “Improving financial literacy and building lifelong financial skills is the first step to financial mobility—and through financial mobility, we can strengthen financial futures for all and realize positive change for the next generation.”

Fidelity’s renewed commitment to financial education includes several new initiatives across the country:

A FinEd Champion Program: This associate engagement program will offer enhanced financial education training to volunteers so they can make direct student impact in classrooms and in their community. Resources include talking points, games, and online learning modules. FinEd Champions will also have access to volunteer opportunities in their region, receive professional development opportunities, and be connected with other FinEd Champions in their region. Over 500 associates enrolled in the first month of recruitment.

In-School Learning Opportunities for Students and their Families: Fidelity has launched regional pilots, including in Boston and Covington, where it works with public school systems to offer financial education programing to students, teachers, and families by coordinating classroom visits with Fidelity associates to share their expertise. Fidelity will also host family nights to provide supplemental educational opportunities to parents, siblings, and other household members. And through a collaboration with EVERFI, it will place virtual financial education curriculums in the hands of teachers at 500 high schools across the country.

An Associate-Driven Innovation Challenge: Leveraging the firm’s expertise in incubation and innovation, Fidelity will host a Shark Tank-style event to foster associate-driven ideation that will advance and enhance youth financial education offerings for community partners. Associates from across Fidelity will come together in teams to leverage their skills and solve a real-life challenge tied to Fidelity’s commitment to financial education for underserved middle and high school students.

These associate programs focus on engaging the community, but Fidelity offers financial education to people of all ages, from school-aged children through those managing their retirement.

Fidelity works to embed financial education in everything it offers, from Fidelity Youth® to the ongoing support for its Fidelity Scholars. New this month, Fidelity will launch Women Talk Money: Teen Girl Learning Series, a next generation reboot of the popular Women Talk Money series. It will also roll out new resources and toolkits for its 30M+ workplace plan participants. With research showing that financial habits and norms begin as early as age 5, teens acknowledging the importance of investing, and women’s increased financial confidence resulting in money action, it’s critical that everyone have turnkey opportunities to learn about how to save, spend, and invest, which Fidelity is uniquely positioned to offer.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. Fidelity’s strength comes from the scale of our diversified, market-leading financial services businesses that serve individuals, families, employers, wealth management firms, and institutions. With assets under administration of $12.6 trillion, including discretionary assets of $4.9 trillion as of December 31, 2023, we focus on meeting the unique needs of a broad and growing customer base. Privately held for 77 years, Fidelity employs more than 74,000 associates across the United States, Ireland, and India. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

__________________________________________

The third parties mentioned herein and Fidelity Investments are independent entities and are not legally affiliated.

Fidelity Brokerage Services LLC, Member NYSE, SIPC,

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC,

900 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

245 Summer Street, Boston, MA 02110

1139482.1.0

©2024 FMR LLC. All rights reserved.