- With 74% of Firms Expecting to Complete More M&A Deals in the Future, a More Prescriptive Approach to Valuation Can Lead to Greater Appeal in the Marketplace

- Research Uncovers Opportunities for Clearer Alignment During M&A Negotiations

BOSTON, Jan. 22, 2020 -- Fidelity Clearing & Custody Solutions®, the division of Fidelity Investments® that provides clearing and custody to registered investment advisors (RIAs), brokerdealer firms, family offices, retirement recordkeepers and banks, today released findings from its 2019 M&A Deal Valuation and Structure Study, examining trends and buyer perceptions related to RIA firm valuation and deal structure. The survey of serial acquirers found that firms being acquired are worth more now than they were five years ago, with the median EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) multiple for deals since 2017 reaching 7X, up from around 5X just five years ago.i

While EBITDA multiples have increased, Fidelity’s research also uncovered that sellers appear to have inflated expectations of their firms’ values compared to the reality of the market. Sellers expect an EBITDA multiple ranging from 8X to 10X, according to the buyers surveyed. As a result, buyers surveyed estimate that, on average, nearly 40% of their deal conversations fell through in the last five years due to unrealistic valuation expectations by the sellers.

“Firm valuation is as much of an art as it is a science, and we believe the most successful firms will be those who take the time to understand all of the dynamics involved and align their own motivations with the value their businesses bring to the table,” said Scott Slater, vice president of practice management & consulting, Fidelity Clearing & Custody Solutions. “We continue to see a rapid pace of M&A, but our study showed that there could be even more deals happening if valuation expectations were better aligned.”

Fidelity’s 2019 M&A Deal Valuation and Structure Study surveyed serial acquirers involved in nearly 150 transactions over the last two years, which accounts for more than half of all RIA transactions tracked by Fidelity during that time.

The study also examined how deal structure has changed in the last five years and found:

• 43% of respondents report that for the majority of deals since 2017, over 50% of the transaction is paid upfront, compared with just 30% of respondents saying the same was true in 2014.

• Payout terms are decreasing: The percentage of firms with average payouts of three years or longer dropped from 48% five years ago to 30% since 2017.

Motivations of Sellers and Buyers Differ

The majority of participating firms in the study agreed that unrealistic comparison multiples in large sales (91%) and a lack of understanding of valuation drivers (83%) are the top factors driving sellers to overvalue their businesses. Other drivers include a misalignment between seller cash needs and firm value (61%), being too close to the business to recognize weaknesses (57%) and failure to recognize the synergies sought by buyers (26%).

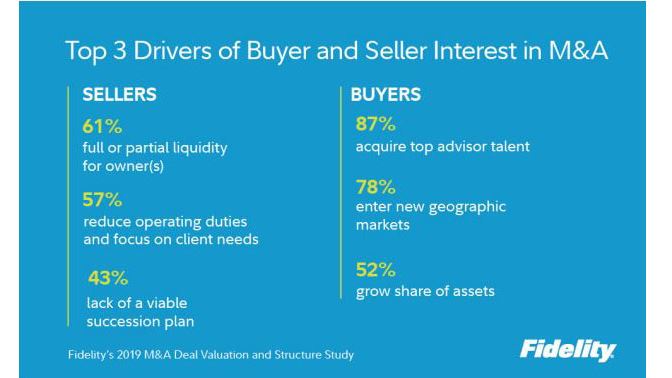

The research also revealed that when it comes to making a deal, sellers and buyers are coming to the table with differing motivations and expectations:

What Else Do Sellers Need to Know?

According to Fidelity’s study, buyers don’t expect deal-making to slow anytime soon. In fact, 74% of participating firms expect to complete more deals in the future, while the rest (26%) are keen to continue their current momentum. None of the firms intend to do fewer deals. With firms expecting increased M&A activity in the future, understanding deal structure is increasingly important.

According to the buyers surveyed, 61% offer stay or retention bonuses to the selling firm’s owners, and deals take an average of nine months to complete.

For more information, including action items for buyers and sellers, please visit the M&A Valuation and Deal Structure — Insights from Leading Serial Acquirers report. This is the fifth report in the Fidelity Wealth Management M&A Series, which offers insights and best practices regarding trends shaping the industry. Fidelity also issues monthly Wealth Management M&A Transaction Reports summarizing M&A activity among RIAs and independent broker-dealers.

About Fidelity Investments:

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $8.2 trillion, including discretionary assets of $3.1 trillion as of November 30, 2019, we focus on meeting the unique needs of a diverse set of customers: helping more than 30 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 financial advisory firms with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 40,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about.

# # #

The content provided herein is general in nature and is for informational purposes only. This information is not individualized and is not intended to serve as the primary or sole basis for your decisions as there may be other factors you should consider. Fidelity Clearing & Custody Solutions does not provide financial or investment advice. You should conduct your own due diligence and analysis based on your specific needs.

Fidelity Clearing & Custody Solutions® provides clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC. 200 Seaport Boulevard, Boston, MA 02210.

913912.1.0

© 2020 FMR LLC. All rights reserved

________________________________

i The 2019 M&A Deal Valuation and Structure Study was fielded online May 29 through Aug 6, 2019. Fidelity was identified as the sponsor of the survey. 23 firms participated in the survey, collectively representing 146 deals in last two and half years (since January 2017) with a median deal size of $250M.

“WITH DEALS UP MORE THAN 40% IN THE LAST YEAR”: Fidelity 2019 and 2018 Wealth Management M&A Transaction Data