Fidelity Reports Unprecedented Growth and Engagement Among Female Investors, Helping an Industry-Leading 15.5 Million Women Make Their Money Work Harder to Grow

BOSTON--(BUSINESS WIRE)-- Fidelity Investments® today shared the results of its 2021 Women and Investing Study which finds more women than ever are taking steps to help their money work harder to grow through investing. In fact, two-thirds (67%) of women report they are now investing savings they have outside of retirement accounts and emergency funds in the stock market, which represents a 50% increase from 2018, when Fidelity last fielded the study.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211008005269/en/

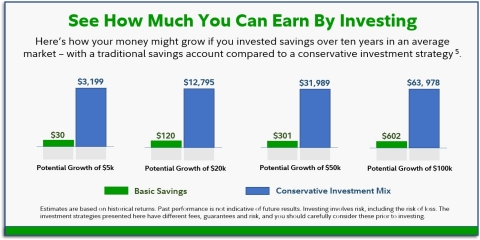

While more women are recognizing the power of investing and taking steps to help their money grow, there are still many who may be keeping significant savings in cash or bank accounts, earning minimal interest and therefore missing out on thousands of dollars in potential earnings. In Fidelity's 2021 Women and Investing Study, roughly half (47%) of women report having $20,000 or more in savings, a third (31%) have $50,000 or more, and approximately 1-in-5 (18%) have $100,000 or more. The growth potential for these funds can be staggering over time. This hypothetical examples illustrate how savings can potentially grow over the course of ten years. (Graphic: Business Wire)

In 2018, Fidelity was already seeing a notable uptick in women getting more hands-on with their finances. That momentum has continued, even as the pandemic has disproportionately impacted women in terms of financial stress and job security. In fact, events of the past year and a half have proven to be a powerful catalyst for even more women to make their finances a priority, from building up emergency savings, to creating or updating financial plans, to making the move from saver to investor.

Yet, amid this progress, there remains a great deal of opportunity for those not yet investing, as well as those who may still be keeping significant savings on the sidelines. Taking proactive steps may bode well for the future as new analysis of more than 5 million Fidelity customers over the last ten years finds that on average, women not only realized positive returns on their investments, but also outperformed their male counterparts by 40 basis points1.

“It’s terrific to see women taking greater control of their finances and getting more invested to help achieve their financial goals,” said Kathleen Murphy, president of Personal Investing at Fidelity Investments. “The last 18 months have been extremely challenging, and for many women, driven historic levels of stress surrounding their finances, job security and long-term savings. However, in working with millions of women across the country, they have clearly demonstrated their ability to persevere and focus on positive financial steps for the future.”

Over the last year, Fidelity has seen an increasing commitment to saving and investing for the future among its own customers as well:

- The firm has seen unprecedented growth in women opening new retail investing accounts, with a record 43% year-over-year increase since last summer2.

- Women are contributing a record-high average 9.2% to workplace savings accounts3.

- There’s been a 37% increase in women taking advantage of Fidelity guidance over the last two years, which has accelerated since the onset of the pandemic. This includes calls with financial consultants and use of online planning tools4.

This momentum is expected to continue, as 9-in-10 women say they plan to take additional steps to get more engaged within the next 12 months. But to get off the sidelines and become more hands on in growing their money, women will need additional support and education to help reframe how they think about investing. While half of women (50%) say they have become more interested in investing since the start of the pandemic, and 42% say they now have more to invest, just 4-in-10 (41%) say they’re comfortable with their investing knowledge. In fact, if given $25,000 to invest, less than half (47%) would know what steps to take to do so.

Furthermore, 70% of women believe they would need to learn more about picking individual stocks before they could get started, and 77% said if they had an advisor to help them invest, they’d feel more confident about their financial future. It’s important to remember there are many options to get invested, including simple approaches, tools to help choose investments appropriate for one’s goals, and abundant help to ensure confident decision making.

Opportunity vs. Opportunity Cost: Calculating Potential

While more women are recognizing the power of investing and taking steps to help their money grow, there are still many who may be keeping significant savings in cash or bank accounts, earning minimal interest and therefore missing out on thousands of dollars in potential earnings.

Roughly half (47%) of women report having $20,000 or more in savings, a third (31%) have $50,000 or more, and approximately 1-in-5 (18%) have $100,000 or more. The growth potential for these funds can be staggering over time. Consider the accompanying hypothetical examples5 of how investing $5,000, $20,000, $50,000 and $100,000 can potentially grow over the course of ten years.

Put Money Stress to Bed by Shifting Your Mindset

Money has always been a leading stressor for women, with the ability to save enough for future goals such as retirement high on women’s list of concerns. More than a third (34%) of women admit that worry about their finances keeps them up at night at least once a month. However, with 9-in-10 women intending to take action with their money within the next year and the increased focus on investing, better sleep may be in their future.

“We’re seeing a notable shift in women wanting to learn more not just about how to start investing, but how to dig deeper – how to evaluate and select different types of investments to align with specific goals and how to manage an existing portfolio to ensure you’re invested appropriately and on track,” said Lorna Kapusta, head of Women Investors and Customer Engagement at Fidelity. “We see time and again when women do get more engaged and ensure their money is invested to achieve what’s important to them, their stress levels go down. When women know their money is working as hard as they do – that’s goodness and helps them feel better about their future.”

Four Tips to Get More Invested

Two-thirds of women (65%) say they’d be more likely to invest, or invest more, if they had clear steps to do so. Here are four easy tips to get started:

- Join the conversation on 10/13 for Fidelity’s next Women Talk Money event. This month’s theme: “5 investing conversations to have now” with special guest Anna Sale, host of the award-winning podcast Death, Sex & Money and the book Let’s Talk About Hard Things.

- Rethink investing at your own pace by checking out Fidelity.com/WomenInvest, a new online resource center that provides practical ‘what you need to know’ education about different aspects of investing, as well as steps to take to get started, give your current portfolio a check-up, or find professional support to help your savings work harder.

- Maximize the opportunity to grow your money by creating a plan now. Fidelity retail account owners can go here to visualize how different savings and investing options can help reach their short- and long-term goals. Not a Fidelity customer yet? Answer seven easy questions for a suggested strategy and next steps to reach your personal goal.

- Take advantage of free guidance. Everyone has questions, so don’t hold back from asking yours. Fidelity representatives are available at no cost to answer questions 24/7 at 1-800-FIDELITY, or online at Fidelity.com.

Additional resources:

- For employers, Fidelity shares tools kits providing insights on the challenges facing women and caregivers in their workforce and how to help, including: Making Your Money Work, At Work, The financial realities of being a woman, and Blazing pathways to women’s financial wellness.

- Fidelity’s Life Events hub, an online experience designed to help plan for and manage major life milestones. This includes a robust library of checklists and other guidance for more than three dozen different life events including managing a job change, caring for aging loved ones, experiencing divorce and losing a loved one.

About the Fidelity Investments 2021 Women and Investing Study

This study presents findings from a nationwide survey of 2,400 American adults (1,200 women and 1,200 men). All respondents were 21 years of age or older, have a personal income of at least $50,000 and are actively contributing to a workplace retirement savings plan, like a 401(k) or 403b. This survey was fielded in July 2021 by CMI Research, an independent research firm not affiliated with Fidelity Investments. Fidelity was not identified as the sponsor of this study. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $11.2 trillion, including discretionary assets of $4.3 trillion as of August 31, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 38 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 wealth management firms and institutions with investment and technology solutions to drive growth. Privately held for more than 75 years, Fidelity employs more than 52,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit http://www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

The third-party trademarks and service marks appearing herein are the property of their respective owners.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 02110

998192.1.0

© 2021 FMR LLC. All rights reserved.

1 Analysis of the investing behavior of retail customers, comparing the annualized return of assets of 5.2 million self-directed retail accounts from Jan 2011 – Dec 2020.

2 New retail account openings by women as of 6/30/21.

3 Based on Fidelity analysis of 23,600 corporate DC plans (including advisor-sold DC) and 19.8 million participants as of 6/30/21.

4 Fidelity customer data, representing a year-over-year percentage increase in women taking advantage of guidance interactions between 7/1/19 and 06/30/21

5 Projections are based on past performance. Past performance does not predict future results. The timing of deposits and when you are looking to use the money can impact potential return as well as which savings or investment options may be right for you. Hypothetical models include the following assumptions:

- The average market return corresponds to the 50th percentile of the returns. Conservative Investing mix is based on 20% stocks, 50% bonds, 30% short term investments. Estimated/Average return rates stay constant over the course of the goal

- You won't make any withdrawals from the account during the goal timeframe

- No fees or taxes will be applied

- Your starting amount and monthly contributions are invested in the model allocation in the stated time period

- Investments in "traditional savings" and "locked savings" assumes only FDIC insured accounts or certificates of deposits are used

For investing returns, calculations are made by computing the 1, 2, 3, 4, 5, 6, 7, 8, 9, and 10-year average annual returns based on monthly historical performance of stocks, bonds and short-term instruments from 1926-2017, obtained from Ibbotson Associates. Past performance is no guarantee of future results. Returns include the reinvestment of dividends and other earnings. The assets are rebalanced monthly to the stated asset mix. Any chart is for illustrative purposes only and does not represent actual or implied performance of any investment option. Stocks are represented by the Dow Jones Total Market Index from March 1987 to latest calendar year. From 1926 to February 1987, stocks are represented by the Standard & Poor's 500® Index (S&P 500® Index). The S&P 500® Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. Bonds are represented by the Barclays U.S. Aggregate Bond Index from January 1976 to the latest calendar year. The Barclays U.S. Aggregate Bond Index is a market value-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of one year or more. From 1926 to December 1975, bonds are represented by the U.S. Intermediate Government Bond Index, which is an unmanaged index that includes the reinvestment of interest income. Short-term instruments are represented by U.S. Treasury bills, which are backed by the full faith and credit of the U.S. government. The average market return corresponds to the 50th percentile of the returns, the below average market return corresponds to the 25th percentile of the returns, and the significantly below average market return corresponds to the 10th percentile of the returns. Savings returns are calculated using a national average savings account rate from FDIC. Locked rate savings returns are calculated using national average CD rates for 1-, 2- and 5-year CDs from BankRate. CDs are assumed to be purchased once and are not being rolled over upon maturity. When purchasing CDs from within a savings account, all additional monthly contributions into the savings account, as well as continuing savings with the proceeds of a CD after it matures, are assumed to be earning a national average saving account rate from FDIC.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211008005269/en/

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Michelle Tessier

(201) 915-7470

michelle.tessier@fmr.com

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to email alerts for news from Fidelity

Source: Fidelity Investments