- mericans Split on How Long It Will Take to Get Back On Track, Ranging from 1 - 4+ Years

- Planning Can Play Transformative Role, Providing Greater Peace of Mind During Times of Uncertainty and Greater Confidence in Retiring

- Millennials Lead the Pack In Having a Plan to Help Them Retire Where and How They Want

BOSTON, March 24, 2021 -- As more than one year has passed since the start of the pandemic and with the increasing availability of vaccines, many Americans are focusing on the future, including sizing up their prospects for retirement. The need is real. According to Fidelity Investments’® 2021 State of Retirement Planning Study, more than eight-in-ten Americans (82%) indicate the events of the past year have impacted their retirement plans1, with one-third estimating it will take 2-3 years to get back on track, due to such factors as job loss or retirement withdrawals. Encouragingly, the vast majority are still confident they’ll be able to retire when and how they want, and 36% are now even more confident in their retirement plan than before.

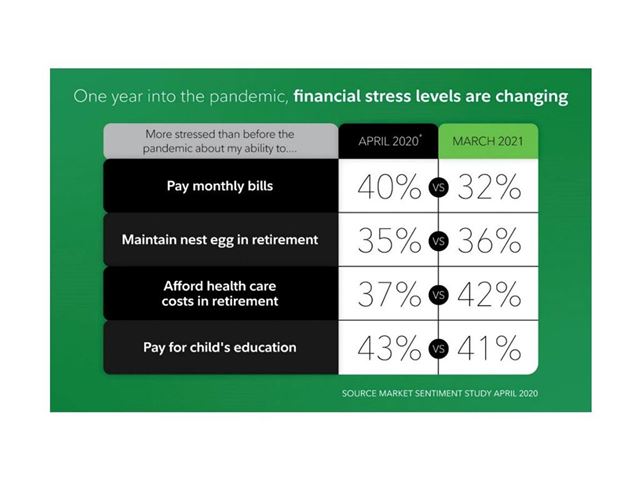

As the largest retirement provider in the U.S., Fidelity works with a broad spectrum of savers who have a diverse set of financial needs, challenges and goals, and the study, which focuses on the impact of the past year on retirement plans, points to the positive impact having a retirement plan in place can have on helping people weather the storm. Still, according to the findings, 79% of respondents indicate they re-evaluated their priorities this past year, and while the level of concern has diminished in some areas since the start of the pandemic2, when compared against the pre- pandemic world, people are still more stressed than before on several fronts.

“This past year has been a roller coaster, but for those Americans with a retirement plan, it should come as a relief to know the fundamentals remain sound,” said Melissa Ridolfi, senior vice president of Retirement and Cash Management at Fidelity Investments. “Although the survey indicates 36% of Americans are more concerned now than at the start of the pandemic on their ability to maintain a nest egg in retirement, at Fidelity, we saw retirement savings accounts reach record levels in the fourth quarter of 2020 and also experienced record levels of plannin engagements with clients throughout the year. This is a remarkable validation of the faith so many retirement savers have in their own financial future and their ability to move forward confidently.”

Want to Improve Your Peace of Mind? Plan for Your Future.

For those looking to strengthen their financial future, the study also validates the important role planning can play. According to the findings, simply taking steps to visualize a plan for your retirement can lead to a greater sense of confidence and control. Overall, when it comes to how people are planning for retirement, Americans fall into three categories:

Here’s where the power of planning comes in: the study offers strong evidence of a transformative effect on one’s financial outlook for those who have started thinking in detail about how to afford the retirement they want.

Across the board, those with the most detailed plan in place to achieve their goals reported experiencing the greatest confidence. However, even the simple act of getting started on a plan can have a positive impact. When asked at what point in the retirement planning process people started feeling more relaxed about their situation, it appears that the experience is highly personal and that there are a number of points that people find emotionally gratifying.

Interestingly, Millennials are slightly more likely than their older counterparts to report having a plan to afford their desired lifestyle in retirement (35%), compared to Gen X-ers (34%) or Boomers (32%), even though Boomers are closest to retirement. Part of this may be attributed to the fact that Millennials are nearly twice as likely to have reported using online tools and calculators than Boomers. These tools can provide the instant gratification of seeing a plan taking shape with just a few clicks, something many have become accustomed to in a digital age.

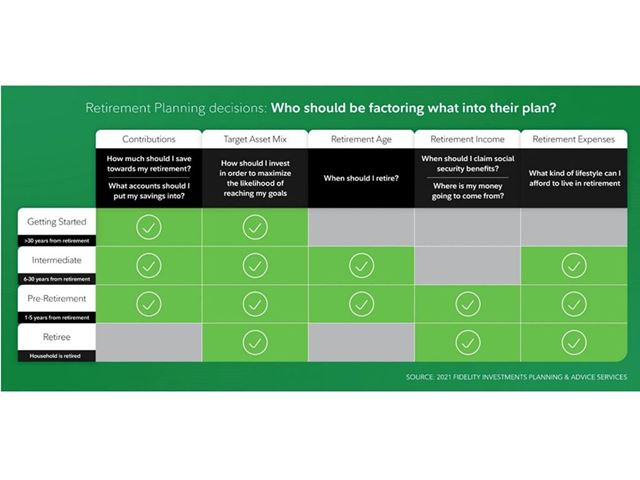

Additionally, the key considerations, or ingredients for a “plan” differs by generation. For those 30 years from retirement, including most Millennials, having a plan means you’ve determined how much you should be saving on a regular basis and what accounts you should put those savings into based on tax and investing considerations. As people start to get closer to retirement, they need to think and plan for more complex topics.

“For those with a longer time horizon, it may be comforting to know that putting a plan in place may be easier than you think, and will give you the perspective to focus on what you need to do to achieve your goals,” said Ridolfi. “If you are closer to retirement, the good news is, it’s never too late to start planning for your future, regardless of age or income. The study findings clearly show that creating a plan for retirement can lead to a greater sense of confidence and control and ultimately give people a better feeling about where they stand at any age.”

Extra Credit: Consider These Important Retirement Guidelines

To create a strong and achievable plan, it can be helpful to understand where you need to go, and when it comes to retirement, the study uncovers several areas of opportunity when it comes to understanding important retirement rules of thumb. Among them:

- How much to save for retirement: Only 25% of respondents accurately indicated that financial professionals recommend having 10-12 times your last full year of working income by the time you reach retirement. Half of all respondents thought the figure would be only 5 times or less.

- How much to withdraw in retirement: 28% said that financial professionals would recommend a withdrawal rate of 10 to 15% of retirement savings every year, a withdrawal rate that would use up one’s retirement savings quickly. Withdrawing that amount would be far above Fidelity’s suggested rate of 4 to 5 percent annually.

- Market Returns: Almost three-quarters (72%) of respondents believe the stock market3 has seen negative returns more frequently than positive ones over the past 35 years. It may come as a pleasant surprise for people to learn that the stock market has had a positive annual return for 26 out of the past 35 years.

- The cost of out-of-pocket health care expenses: Most respondents underestimate the cost of out-of-pocket health care for a couple in retirement, with 37% guessing between $50,000-100,000. In fact, for a couple retiring at 65, the actual average cost throughout their retirement is three times higher, at $295,0004.

- Full retirement age for Social Security: Although you can start receiving Social Security retirement benefits as early as age 62, you have to wait a few more years before you reach Full Retirement Age (FRA). Claiming Social Security benefits any time before you reach FRA can lock in a permanent reduction in monthly income. Doing some research on this may be helpful, as only 17% correctly identified their Full Retirement Age (FRA) for Social Security, including 44% of Gen X-ers, who underestimated their FRA of 67.

- The impact of divorce on Social Security: There’s good news on this front. While 63% of respondents think a former spouse has the ability to reduce their monthly benefits, the truth is, one’s Social Security benefit is not reduced if an ex-spouse claims some of their Social Security benefits.

Looking to Get Started?

One of the most helpful and motivating pieces of information people can get is an understanding of what they’re tracking to vs. what they might need to retire. To help investors get this perspective, Fidelity created the Fidelity Retirement Score, which reflects the percentage an individual or household is anticipated to have saved as compared to the income Fidelity estimates they may need in retirement. Fidelity customers and those who sign up for guest access can get their score in the Planning and Guidance Center and can use a host of planning tools to create and refine a plan for their retirement over time. A high-level version of the score is also available to everyone at www.fidelity.com/score by answering just six short questions. Both allow savers to easily model changes to see how that may impact their score and view steps for improving retirement preparedness based on their score. In addition, Fidelity offers a variety of other resources:

- Educational Fidelity Viewpoints® articles, including “Retirement savings: Who's on target?,” “The three A’s of successful saving” and a Retirement Roadmap Special edition devoted exclusively to retirement planning. For those who want to work on financial literacy, there’s a series of four quick, easy lessons designed to boost people’s confidence in making informed investing decisions.

- Seminars and online learning modules to help learn about key retirement issues and how to prepare for them.

- Teams at Fidelity’s more than 200 Investor Centers nationwide are meeting virtually with clients to plan for retirement and other aspects of their financial futures. You may also call 1-800- FIDELITY (1-800-343-3548) for a consultation with an investment professional.

For a detailed look at the Fidelity Investments’® State of Retirement Planning Study, go here.

About the Fidelity Investments State of Retirement Planning Study

This study presents the findings of a national online survey, consisting of 1,204 adult financial decision makers who were not retired. Respondents had at least one investment account and those over age 34 had at least $100,000 investable assets. The generations are defined as: Baby Boomers (born 1946-64), Gen X (born 1965-80), Millennials (born 1981-96) and Gen Z (born 1997-2012). Interviewing for this CARAVAN® Survey was conducted February 5-12, 2021 by Engine Insights, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $10.2 trillion, including discretionary assets of $3.9 trillion as of February 28, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 35 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 institutions with investment and technology solutions to invest their own clients’ money. Privately held for more than 70 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

IMPORTANT: The projections or other information generated by the Planning & Guidance Center's Retirement Analysis regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Your results may vary with each use and over time.

1 Among people who have lower confidence levels than prior to the events of the past year.

2 Financial stress levels for the State of Retirement Planning study were compared against results secured for a Fidelity Investments Market Sentiment Study conducted in April 2020.

3 SOURCE: S&P 500

4 Estimate based on a hypothetical couple retiring in 2020, 65-years-old, with life expectancies that align with Society of Actuaries' RP-2014 Healthy Annuitant rates with Mortality Improvements Scale MP-2017. Actual assets needed may be more or less depending on actual health status, area of residence, and longevity. Estimate is net of taxes. The Fidelity Retiree Health Care Cost Estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, Original Medicare. The calculation takes into account cost- sharing provisions (such as deductibles and coinsurance) associated with Medicare Part A and Part B (inpatient and outpatient medical insurance). It also considers Medicare Part D (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by Original Medicare. The estimate does not include other health-related expenses, such as over-the-counter medications, most dental services and long-term care.