- Fidelity’s Inaugural “State of the American Investor” study examines trading behaviors and attitudes of retail investors

- Differences emerge between seasoned and less-tenured investors, with years of experience translating to a lower risk tolerance and more pessimistic outlook

- Fidelity’s powerful tools and research capabilities help self-directed investors build confidence in trading, while offering unparalleled investment choice

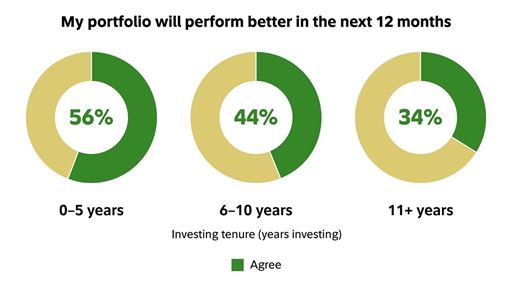

BOSTON, August 19, 2025 – Recent bouts of market volatility aren’t dimming investor confidence, as nearly two-thirds of self-directed traders expect their portfolios to perform the same or better in the coming months, according to Fidelity Investments’ inaugural State of the American Investor study. That said, as investors gain more experience, they also develop a more pessimistic outlook and lower risk tolerance, likely after trading through a longer history of market fluctuations.

Fidelity’s inaugural study analyzed sentiment and behaviors of “DIY investors,” or those who manage their own portfolios, revealing insights into how American investors are finding opportunities for growth while limiting losses and testing new trading strategies.

Despite nearly half of self-directed investors predicting the market will perform worse in the next 12 months, most (64%) believe their own portfolios will perform the same or better in the same time period. This trading confidence translates into action, with nearly half of self-directed investors surveyed saying they see dips in the market as opportunities to invest more. This finding aligns with the behaviors of Fidelity’s traders, who maintained a buy-sell ratio of 1.83 during the market upheaval in April 2025[1].

“Navigating shifting market conditions can be daunting for even the most experienced investors,” said Josh Krugman, SVP, brokerage at Fidelity Investments. “Whether they’ve been investing for more than a decade or only recently started trading, the strength of Fidelity’s platform and the depth of our capabilities provide traders with the tools, timely insights, and resources they need to be confident investors.”

Tenured investors display caution and seek stability, while newer investors focus on gaining knowledge and high-growth opportunities

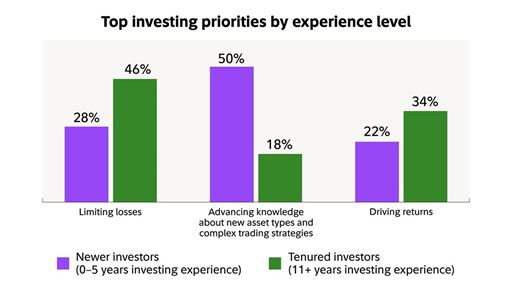

Nearly half of tenured investors (those with more than 10 years of experience actively investing) are prioritizing limiting losses in the year ahead, while the top priority for newer investors (those with 5 or fewer years of investing experience) is to advance knowledge about new asset types or complex trading strategies.

To accomplish their more conservative goals, seasoned investors plan to seek out more stable investments and are approaching this year with more caution, as 35% indicate they have a lower risk tolerance in 2025 than they did last year.

Newer investors are more bullish than their seasoned counterparts, with nearly half indicating they plan to seek out higher-growth stocks in 2025. They are also more likely to say they are familiar with non-traditional assets and advanced income-generation strategies, including covered calls, bond ladders and fully paid lending. Tenured investors, on the other hand, are more familiar with more traditional investment vehicles that provide income such as dividend-paying stocks and high yield money market funds, leaving opportunity for even the most tenured investors to increase their confidence when it comes to income strategies.

Newer investors are also planning to seek out more non-traditional assets in the year ahead:

- 69% of newer investors say they are confident in investing in non-traditional assets, compared to 29% of seasoned investors

- 72% of newer investors say they are familiar with crypto, compared to 35% of seasoned investors

- 48% of newer investors say they are seeking out higher growth stocks in the year ahead, compared to 30% of seasoned investors

- Newer investors are 5 times more likely than seasoned investors to plan to start using margin and option trading strategies for the first time during the next 12 months.

Notably, the study found a correlation between tenure and expectations, as traders with more experience expressed less optimism about the future performance of both the stock market and their own portfolios. However, these investors are more likely to understand the natural gyrations of the market, with 69% saying market volatility is to be expected, compared to 46% of newer investors.

Another key differentiator between newer and tenured investors is where they source their investing advice. More than 1-in-3 newer investors admit they make most of their investing decisions from social media, compared to just 1-in-10 of tenured investors. This is a note of caution for newer investors: while social media can be a vehicle for sharing investing information, nearly half of newer investors also say they have made a bad investment decision based off information from social media, which is why it’s critical to seek out reputable sources for education and trading ideas.

How investors achieve success

The study also uncovered insights on the makings of a successful investor. With 86% of self-directed investors saying they have felt successful in recent years, it’s worth examining how this group approaches trading. Notably, they are less likely to sell their investments during dips in the market and are more likely to agree market volatility is to be expected. Self-described successful investors also prioritize different factors when making an investment decision, with the investment’s historical performance as the top factor. Investors who say they’ve felt unsuccessful prioritize general market sentiment. These less confident investors are also more likely to consider news coverage, social sentiment or influencer recommendations when evaluating an investment.

Additionally, investors who say they are successful are much more likely to be comfortable in the amount of risk they take with their portfolios, with 85% indicating they take on the right amount of risk for their goals, compared to 67% of “unsuccessful” investors.

“Identifying the right mix of investments to meet financial goals constantly evaluating risk and reward,” said Krugman. “Often, we hear from clients that they want help understanding how to take advantage of more advanced strategies like income generation from fully paid lending or exploring multi-leg options trades. Our platform combines the education, insights and trading tools these clients need to build confidence and feel successful.

Resources to build investor confidence and enhance outcomes

As investors grow their portfolios and enhance their investing know-how, Fidelity has tools, research, and coaching available to support self-directed investors of all levels and tenures in meeting their financial goals.

- For investors looking to make sense of the markets and the economy, Fidelity Viewpoints® share perspectives on everything from how to evaluate a stock to how to get started investing.

- For traders looking for professional guidance on trading topics: Fidelity’s Trading Strategy Desk® offers daily market briefings, sessions on managing risk and options strategies, overviews of trading tools and technical analysis, as well as live Q&A with Fidelity professionals.

- For those looking to build their options expertise, Options Strategy Builder takes traders through the process of placing an options trade step by step; or for more experienced options traders, Fidelity’s options profit/loss calculator models outcomes for single and multi-leg strategies.

- For those seeking a simple way to manage an income stream with bonds, the Fixed Income Dashboard helps investors understand their portfolio’s composition and analyze cash flows.

- For investors diving deeper into crypto, Fidelity’s Covering Crypto Livestreams share explainers and analysis on crypto markets.

- For live market data and powerful analysis tools built into the web experience on Fidelity.com, Fidelity Trading Dashboard helps bring trading strategies to life.

- For traders looking for a macro analysis on current events, weekly Market Sense webinars feature Fidelity professionals analyzing market events and discussing how economic and policy shifts impact investments.

About the 2025 State of the American Investor Study

This study presents the findings of a national online survey, consisting of 2,007 U.S. adults, 18 years of age and older with a household income of $25,000 or more, at least $25,000 in investable assets outside of retirement and real estate, and use at least one financial firm or online trading platform for investing outside of retirement. Interviewing was conducted April 15 – 24, 2025, by Big Village, which is not affiliated with Fidelity Investments. The results may not be representative of all adults meeting the same criteria as those surveyed. The theoretical sampling error for all respondents is +/- 2.1 percentage points at the 95% confidence level. Smaller subgroups will have larger error margins. Fidelity was not identified as the sponsor of this study.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. Fidelity’s strength comes from the scale of our diversified, market-leading financial services businesses that serve individuals, families, employers, wealth management firms, and institutions. With assets under administration of $16.4 trillion, including discretionary assets of $6.4 trillion as of June 30, 2025, we focus on meeting the unique needs of a broad and growing customer base. Privately held for 79 years, Fidelity employs more than 78,000 associates across the United States, Ireland, and India. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

###

Investing involves risk, including risk of loss.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss

You could lose money by investing in a money market fund. An investment in a money market fund is not a bank account and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Before investing, always read a money market fund’s prospectus for policies specific to that fund.

Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options. Supporting documentation for any claims, if applicable, will be furnished upon request.

Fidelity Brokerage Services LLC, Member NYSE, SIPC,

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC,

900 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

245 Summer Street, Boston, MA 02205

1218415.1.0

© 2025 FMR LLC. All rights reserved

[1] Monthly average of daily trades placed by Fidelity brokerage customers from 4/1/25 - 4/30/25